Sukanya Samriddhi Yojana (SSY) is a small savings scheme of the Central Government for daughters which has been launched under the Beti Bachao-Beti Padhao scheme. Sukanya is the scheme with the best interest rate among small savings schemes. Through which the beneficiary gets relief from the expenses incurred on education and marriage. How to get, benefits of the scheme and how to apply to avail the benefits of the scheme. To get all this information you will have to read this article till the end. So let us know – about Sukanya Samriddhi Yojana.

सुकन्या समृद्धि योजना

The Central Government has implemented Sukanya Samriddhi Yojana (SSY) for girls below 10 years of age to save for higher education and marriage. This is a small savings scheme which has been launched under the Beti Bachao-Beti Padhao scheme. This scheme was started by the Prime Minister of India Narendra Modi on 22 January 2015. All those parents who want to deposit money for their daughter’s education and marriage can open a savings account under Sukanya Samriddhi and avail the benefits of the scheme.

Sukanya Samriddhi Yojana Latest Update

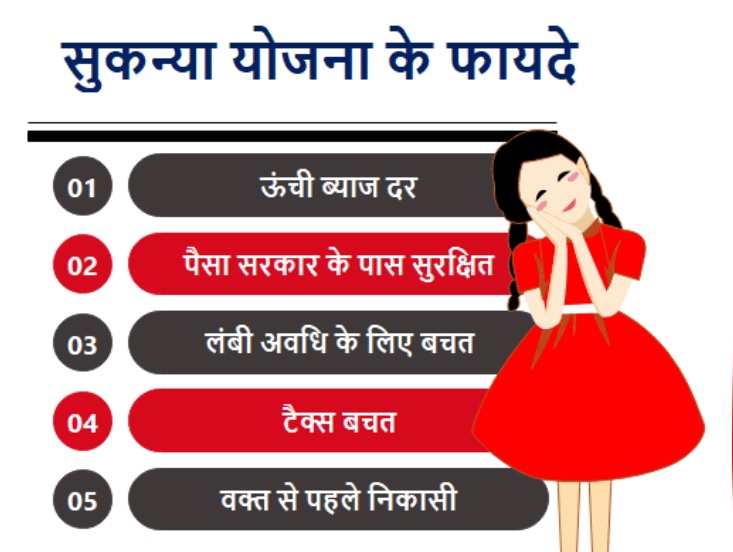

09 types of savings schemes have been run in the country by the Indian Postal Department. Which is known as Post Office Saving Scheme. These are 09 types of savings schemes – Post Office Savings Account, Post Office Time Deposit Account, Post Office Monthly Income Scheme, Public Provident Fund, Sukanya Samriddhi Yojana, National Saving Certificate, Post Office Time Deposit for 5 years, Kisan Vikas Patra and Senior Citizen Saving Scheme. The interest rates of all these savings schemes are revised by the government from time to time, so that more and more beneficiaries are able to avail the benefits of the schemes. Sukanya Samriddhi Yojana is the key to improve the economic condition of tribal girls, under which the beneficiaries get an interest rate of 7.6 percent.

Interest rate for Sukanya Samriddhi Yojana

As per the financial year 2020-21, currently, the Sukanya Samriddhi Yojana interest rate has been set at 7.6%. The interest rate is fixed by the Government of India and revised on quarterly basis. Let us take a look at the historical Sukanya Samadhi interest rates –

Where to open an account for Sukanya Samriddhi Yojana / how much will be the amount to open the account

You can open Sukanya Samriddhi Account in your nearest post office. This account is opened from the birth of the daughter till she turns 10 years old. In which only one account can be opened for a daughter. The account will be opened with a deposit of Rs 250/-. Earlier this amount was Rs 1000/-, but according to the new rule of the government, it has now been reduced to Rs 250/-. A maximum of Rs 1.5 lakh can be deposited in a year.

Who will be the guardian for opening Sukanya Samriddhi Yojana account?

Parents will be made guardians to open the account of Sukanya Samriddhi Yojana. The account in the daughter’s name will be opened only under his supervision.

Must Read: All other Central Government Yojana

How many daughters of the family will get the benefit of Sukanya Samriddhi Yojana?

Only two daughters of a family can avail the benefits of Sukanya Samriddhi Yojana. If there are twin daughters in a family, then the benefits of this scheme will be given to them separately. This means that three daughters of that family will get the benefit of the scheme. Twin daughters will be counted equally but they will be given different benefits. Under the scheme, accounts can be opened for girls below 10 years of age.

Age limit for opening Sukanya Samriddhi Yojana account

Sukanya Samriddhi Yojana account: Daughter’s bank account can be opened from 0 to 10 years of age. If the daughter’s age is more than 10 years, then a bank account cannot be opened in that case.

Eligibility for Sukanya Samriddhi Yojana

- Permanent resident of the country

- Only girls will be eligible for the scheme.

- Two girls from a family will be eligible for the scheme.

- To open an account under the scheme, the age of the girl child should be less than 10 years.

Objective of Sukanya Samriddhi Yojana

The main objective of Sukanya Samriddhi Yojana is to strengthen the economic side of the daughters and easily meet the expenses on their education and marriage. So that a positive environment is created for daughters in the country, so that the discrimination between sons and daughters in India can be reduced.

सरकार द्वारा बच्चियों को आर्थिक सुरक्षा देने के सुकन्या समृद्धि योजना चलाई जा रही है। इस योजना में निवेश करने पर अब सालाना 8% ब्याज दिया जा रहा है। आज इंटरनेशनल गर्ल चाइल्ड डे पर जानिए इसके बारे में सब कुछ.. #SukanyaSamriddhiYojanahttps://t.co/ScLPwi1NPV

— Dainik Bhaskar (@DainikBhaskar) October 11, 2023

Documents required for Sukanya Samriddhi Yojana SSY

- Baby girl birth certificate

- Address proof

- Identity certificate

- Bank account

- Two passport size photographs of parents

- Mobile number

How much money will be paid annually for Sukanya Samriddhi Yojana

- Under Sukanya Samriddhi Yojana, the beneficiary will first have to pay Rs 1000/- per month. Which has now been reduced to only Rs 250/- per month.

- Investment in the scheme can range from Rs 250/- to Rs 150000/-. In which it will be mandatory to invest for 14 years after opening the bank account.

For how many years will the money have to be deposited for Sukanya Samriddhi Yojana?

For Sukanya Samriddhi Yojana you have to deposit money for 14 years. After that you will get interest as per the rates applicable at that time on the account.

When will the account of Sukanya Samriddhi Yojana mature?

The account will mature only after the daughter completes 21 years from the date of account opening. If the girl gets married after 18 years or before 21 years then the account will be closed after the date of marriage. After closure of the account, the deposited amount can be withdrawn along with interest.

Tax benefits

Under Section 80C of the Income Tax Act 1961, the amount deposited in Sukanya Samriddhi Yojana, interest amount and maturity amount have been made tax free. For which a rebate of up to Rs 150000/- has been provided by the government. The remaining amount will be received by the beneficiary after the maturity of SSY.

How to deposit money in Sukanya Samriddhi Yojana account

- Sukanya Samriddhi Yojana 2022 account funds can be deposited through cash or demand draft.

- The amount can also be deposited through electronic transfer mode through core banking system in post office or bank. To open an account for that, you will have to write the name and name of the account holder. By adopting these methods any beneficiary can deposit money in his daughter’s account.

Sukanya Samriddhi Yojana Account Transfer Process

- Under Sukanya Samriddhi Yojana, if any beneficiary wants to transfer the account to another place, then he can transfer the Sukanya Samriddhi Yojana account without any inconvenience and without paying any fee.

- For this, the beneficiary will have to submit the proof of transfer in the post office or bank.

- If the account holder is not able to provide proof of transfer for any reason, then the account can be transferred by paying a fee of Rs 100/-.

Under what circumstances Sukanya Yojana account can be closed

- Under the new rule, in case of death of the girl child under Sukanya Scheme, the account can be closed before the maturity period.

- The bank account can be closed before the maturity period in case the account holder gets treatment for a life-threatening illness or in case of death of a parent.

How to open Sukanya Samriddhi Yojana account again

To reopen the account of Sukanya Samriddhi Yojana, the beneficiary has to go to the bank or his nearest post office, where he has a registered account. Now the beneficiary will be given a form to fill to re-open the account. The beneficiary has to submit it after filling the information given in it and paying the outstanding amount. After the entire process is completed, the beneficiary’s account under the scheme will be reopened.

[If the beneficiary has not paid Rs 250/- for 2 years, then you will have to pay Rs 500/- as penalty and a penalty of Rs 50/- per year. In which the penalty for 2 years will be Rs 100/-. If the beneficiary has not paid the minimum amount in the Sukanya Samriddhi Yojana account for 2 years, then a minimum of Rs 600/- will be paid by the beneficiary. In which the beneficiary will have to pay a minimum amount of Rs 500/- for 02 years and a penalty of Rs 100/- for 02 years.]

Benefits of Sukanya Samriddhi Yojana

- Only daughters will get the benefit of this scheme.

- Those who have two daughters at home will also benefit from this scheme.

- This scheme will promote economic empowerment of girls in the country.

- This scheme will help in the education of girls and their marriage.

- To avail the benefit of this scheme, the age of the girl should be less than 10 years.

- The girl should be Indian.

- Up to 50% of the amount can be withdrawn when the girl turns 18 years of age.

- After 21 years the account will be closed and the money will be given to the guardian.

- The future of girls will be secure with this scheme.

- This scheme improves the economic condition of the beneficiaries.

- For this scheme, the beneficiary can easily open an account in any bank or post office.

- Under this scheme, a maximum of Rs 1.5 lakh can be deposited during the financial year.

Main features of Sukanya Samriddhi Yojana

- To make girls self-reliant and empowered

- Government will provide assistance

- There will be improvement in economic aspect

- Financial assistance will be provided during marriage and studies

- Girls’ future will be bright

Authorized bank for Sukanya Samriddhi Yojana

A total of 28 banks have been designated by the Reserve Bank of India (RBI) for opening Sukanya Samriddhi Yojana accounts. In which the beneficiaries can avail the benefits of the scheme by opening an account of Sukanya Samriddhi Yojana in any of the following banks –

- Allahabad Bank

- State Bank of India (SBI)

- Axis Bank

- Andhra Bank

- Bank of Maharashtra (BOM)

- Bank of India (BOI)

- Corporation Bank

- Central Bank of India (CBI)

- Canara Bank

- Dena Bank

- Bank of Baroda (BOB)

- State Bank of Patiala (SBP)

- State Bank of Mysore (SBM)

- Indian Overseas Bank (IOB)

- Indian Bank

- Punjab National Bank (PNB)

- IDBI Bank

- ICICI Bank

- Syndicate bank

- State Bank of Bikaner and Jaipur (SBBJ)

- State Bank of Travancore (SBT)

- Oriental Bank of Commerce (OBC)

- State Bank of Hyderabad (SBH)

- Punjab and Sindh Bank (PSB)

- Union Bank of India

- Uco bank

- United Bank of India

- Vijay Bank

How to apply for Sukanya Samriddhi Yojana (SSY) 2023

Download Application form PDF —- Click here

- First of all the applicant has to download the Sukanya Samriddhi Yojana form

- The information given in it has to be read carefully.

- Now start filling the form.

- If you have filled the form then check it again to see if there is any mistake in it. Only after that you can follow the next step.

- Now you have to go to your nearest post office and submit this form.

- Now further action will be taken by the officer. After all the proceedings are done he will give you the receipt/account number/passbook.

- In this way, after all the process is done, the account for Sukanya Samriddhi Yojana (SSY) 2021 has been opened.

- Now you can deposit an amount of Rs 250/-.

- If you have not received any information about this scheme or are facing any problem while filling the form, then you can contact directly by going to your nearest post office.