Home Loan Scheme: Sometimes in life we have to build a house which is necessary and suitable for living. Here is a good news for the owner of the same construction, the famous Bank of India has launched a new home construction loan scheme for citizens.

Bajaj Housing Finance is offering an interest-free loan of Rs 30 lakh for building a new home to select customers. This is a limited-period offer, and it is available only to customers who meet certain eligibility criteria.

Here are some of the key features of this Home Loan Scheme:

- Loan amount: Rs 30 lakh

- Interest rate: 0%

- Tenure: 12 months

About The Home Loan Scheme

The name of this scheme is Star Kisan Ghar Yojana, and the main reason for this is that this scheme will be implemented mainly for farmers. This scheme will be very beneficial for farmers and common citizens. Because this scheme will definitely be more beneficial than moneylending loans and excess loans charged by other banks.

Through this scheme, a large amount of loan will be made available from the bank at a minimum interest rate to the farmers for building a house or a farm house. As most of the farmers in the village are financially weak, they simply do not have the power to invest lakhs of rupees to build a house at once.

Bajaj Housing Finance Limited

- Home loans

- Loan against property (LAP)

- Balance transfer loans

- Construction finance

- Renovation loans

BHFL is known for its competitive interest rates, flexible repayment options, and quick and easy loan processing. It also has a wide network of branches and customer care centers across India, making it easy for customers to access its services.

Here are some tips for applying for this loan:

- Check your eligibility criteria carefully before applying.

- Gather all the required documents before applying. This will help to speed up the loan processing process.

- Have a clear idea of your budget and the loan amount you need.

- Be prepared to answer any questions that the lender may have.

Home Loan Government Scheme

Now you can get an interest-free loan of Rs 30 lakh for building a new house. Keeping this in mind, Bank of India has launched Star Kisan Ghar Yojana for farmers without any capital to build a house. Along with house construction, if a farmer needs a loan for house repairs, the scheme will also provide loans to farmers for house repairs.

50 Lakh Limit: Star Kisan Ghar Yojana has been launched by the famous Bank of India so the loan limit has also been kept the same. is Under Star Ghar Yojana, if farmers require loan for construction of new house or repair of house Loan facility is being provided from one lakh to fifty lakh rupees, for which the interest rate is 8.5%. Charged will go Citizens should ensure that the benefit of this scheme will be given to the farmers working in agriculture sector.

Also Read :- Shasan Aplya Dari Yojana 2023

Eligibility criteria:

- Salaried individuals with a minimum monthly salary of Rs 50,000

- Self-employed individuals with a minimum annual income of Rs 6 lakh

- Good credit score

Benefits of taking Home Loan Scheme from Bajaj Housing Finance

Here are some of the benefits of taking a home loan sceme from Bajaj Housing Finance:

- Competitive interest rates

- Flexible repayment options

- Quick and easy loan processing

- Wide network of branches and customer care centers

- Pre-approved home loans for salaried and self-employed individuals

- Attractive offers and discounts for select customers

Also Read :- Majhi Kanya Bhagyashree Yojana 2023

Conclusion

There are no major differences between the Bajaj Finance Star Kisan Ghar Yojana and the स्टार किसान घर योजना. Both schemes offer loans of up to ₹50 lakh to farmers for the construction or renovation of their homes. The eligibility criteria and application process are also the same for both schemes.

Additional information about Home Loan Scheme

Both schemes are government-backed and offer competitive interest rates. They are a good option for farmers who are looking to finance the construction or renovation of their homes.

How To apply for Home Loan Scheme

To apply for a home loan, you can follow these steps:

-

Check your eligibility. Lenders have different eligibility criteria for home loans, so it is important to check with a few lenders to see if you qualify. Some common eligibility criteria include:

- Age: You must be at least 21 years old and no more than 75 years old at the end of the loan term.

- Income: You must have a stable income that is sufficient to repay the loan.

- Credit score: Lenders will check your credit score to assess your creditworthiness. A good credit score will make you more likely to be approved for a loan and will also help you get a lower interest rate.

-

Compare loan offers. Once you have checked your eligibility, it is important to compare loan offers from different lenders. Pay attention to the interest rate, loan term, and other fees.

-

Apply for the loan. Once you have found a loan offer that you are happy with, you can apply for the loan. You will need to provide the lender with your personal and financial information. The lender will also need to verify your income and assets.

-

Get the loan approved. Once the lender has processed your application, they will decide whether or not to approve your loan. If your loan is approved, you will need to sign a loan agreement.

-

Receive the loan funds. Once you have signed the loan agreement, the lender will disburse the loan funds to you. You can then use the funds to purchase your home.

Also Read:- Salary for guest teachers doubled, with a monthly compensation

Documents required For Apply Home Loan Scheme:

The following documents are typically required for a home loan application:

- KYC documents (identity and address proof)

- Proof of income (salary slips or P&L statement)

- Proof of business (for self-employed applicants)

- Account statements for the last 6 months

- Property documents (if you have already identified the property)

Tips for applying for a home loan Scheme:

Here are some tips for applying for a home loan scheme:

- Check your eligibility carefully before applying.

- Gather all the required documents before applying. This will help to speed up the loan processing process.

- Have a clear idea of your budget and the loan amount you need.

- Be prepared to answer any questions that the lender may have.

FAQ about Home Loan Scheme:

Here are some frequently asked questions about home loans:

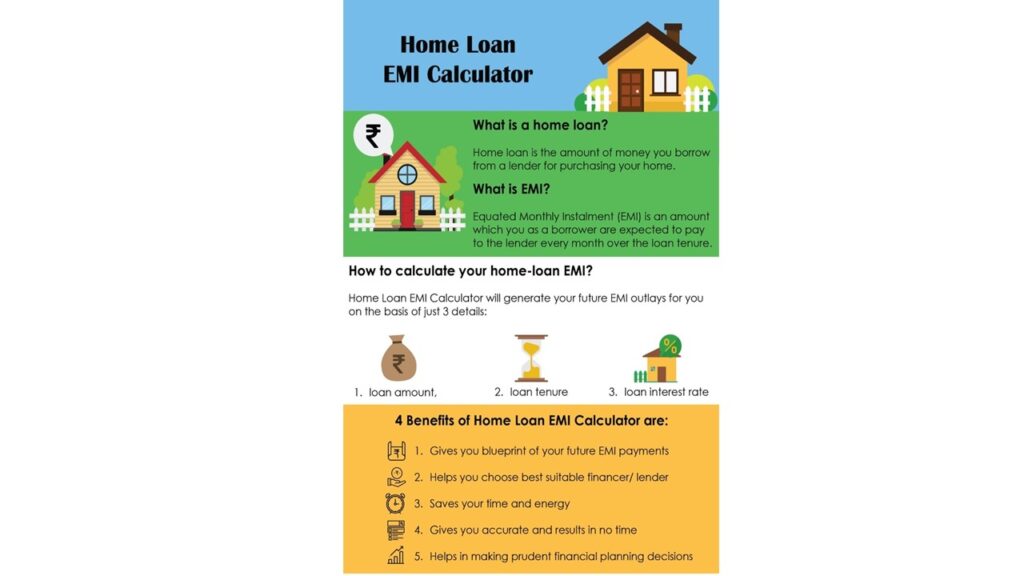

What is a home loan scheme?

A home loan is a type of loan that is used to purchase or renovate a home. Lenders typically offer home loans with a fixed interest rate, which means that the interest rate will not change over the life of the loan. Home loans are typically repaid over a period of 15 to 30 years.

Q: How do I qualify for a home loan scheme?

To qualify for a home loan, you must meet certain criteria, such as having a stable income, a good credit score, and a down payment. Lenders will also consider your debt-to-income ratio, which is the percentage of your monthly income that goes towards debt payments.

Q: How much can I borrow with a home loan scheme?

The amount of money you can borrow with a home loan will depend on your eligibility and the property you are purchasing. Lenders typically lend up to 80% of the purchase price of the property, but you may be able to borrow more if you have a good credit score and a large down payment.

Q: What are the interest rates on home loans scheme?

Interest rates on home loans vary depending on the lender and the current market conditions. However, interest rates are typically low, making home loans a relatively affordable way to purchase a home.

Q: How long does it take to get a home loan scheme?

The time it takes to get a home loan can vary depending on the lender and the complexity of your loan application. However, most lenders can approve a home loan within a few weeks.

Q: What are the closing costs on a home loan Scheme?

Closing costs are the fees that are associated with closing on a home loan. These fees can include things like appraisal fees, title insurance fees, and recording fees. Closing costs typically range from 2% to 5% of the purchase price of the home.

Q: What are the benefits of getting a home loan scheme?

There are many benefits to getting a home loan, including:

- The ability to purchase a home without having to pay the full purchase price upfront.

- The ability to finance the cost of renovations or improvements to your home.

- The ability to take advantage of tax deductions on your mortgage interest and property taxes.

Q: What are the risks of getting a home loan?

The main risk of getting a home loan is that you are responsible for repaying the loan, even if you lose your job or experience other financial difficulties. If you are unable to repay your loan, the lender may foreclose on your home, which means that you will lose your home.

Maharashtra Sarkari Yojana

Maharashtra Lek Ladki Yojana 2023 – लेक लाडकी योजना | Online Registration

Majhi Kanya Bhagyashree Yojana 2023 | माझी कन्या भाग्यश्री योजना | Application Form | Eligibility and Objectives

Shasan Aplya Dari Yojana 2023 | शासन आपल्या दारी योजना क्या है? सम्पूर्ण जानकारी

Saur Krishi Vahini Yojana – मुख्यमंत्री सौर कृषि वाहिनी योजना | MSKVY

Nav Tejaswini Yojana – महाराष्ट्र नव तेजस्विनी योजना

Namo Shetkari Maha Samman Nidhi Yojana – नमो शेतकरी महा सम्मान निधि योजना