Introduction

LIC Dhan Vriddhi Plan is a single premium endowment plan that offers a guaranteed maturity amount and regular income. The plan is designed to provide financial security and growth opportunities to individuals.

Objective of LIC Dhan Vriddhi Plan

The objective of LIC Dhan Vriddhi Plan is to provide policyholders with a guaranteed maturity amount and regular income. The plan also provides protection against premature death.

Highlights

| Name of the scheme | Dhan Vriddhi Yojana 869 |

|---|---|

| Launched by | Life Insurance Corporation of India (LIC) |

| Beneficiary | Citizens of India |

| Assistance provided | To meet the needs of customers |

| Application process | Offline |

| Official website | licindia.in |

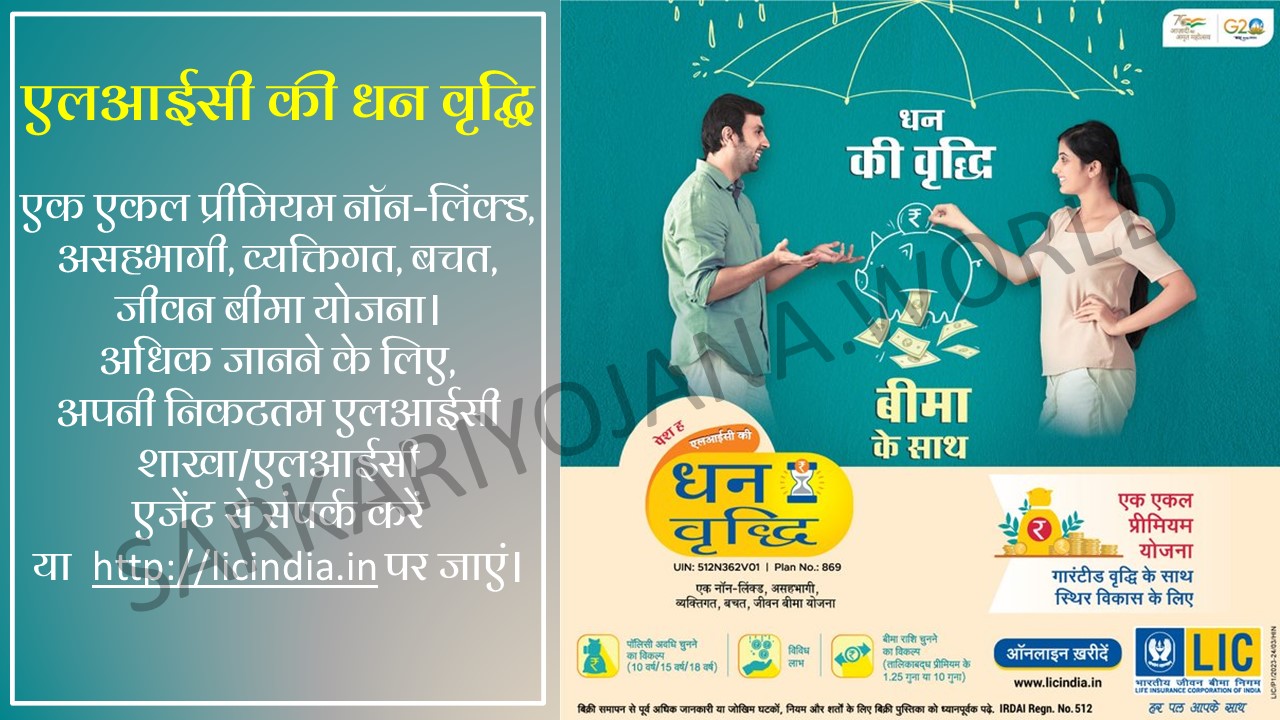

पेश है एलआईसी की धन वृद्धि – एक एकल प्रीमियम नॉन-लिंक्ड, असहभागी, व्यक्तिगत, बचत, जीवन बीमा योजना। अधिक जानने के लिए, अपनी निकटतम एलआईसी शाखा/एलआईसी एजेंट से संपर्क करें या https://t.co/jbk4JUmasB पर जाएं pic.twitter.com/m18iVJBC8m

— LIC India Forever (@LICIndiaForever) June 23, 2023

Eligibility Criteria for LIC Dhan Vriddhi Plan

To be eligible, the policyholder must meet the following criteria:

- The policyholder must be a resident of India.

- The policyholder’s age must be between 8 years and 60 years at the time of commencement of the policy.

- The minimum sum assured is Rs. 10,000 and the maximum sum assured is Rs. 50 lakh.

Documents Required for LIC Dhan Vriddhi Plan

The following documents are required to apply:

- Proof of identity

- Proof of age

- Proof of residence

- Aadhaar card (optional)

Benefits of LIC Dhan Vriddhi Plan

The benefits include:

- Guaranteed maturity amount: The policyholder will receive a guaranteed maturity amount at the end of the policy term. The maturity amount will be equal to the sum assured plus the accrued interest.

- Regular income: The policyholder will receive regular income in the form of paid-up additions throughout the policy term. The paid-up additions are calculated on the sum assured and the guaranteed interest rate.

- Protection against premature death: In case of the policyholder’s death during the policy term, the nominee will receive the sum assured. The nominee will also receive the paid-up additions that have accrued till the date of death.

How to Apply

The application can be made online or offline. The online application form can be found on the LIC website. The offline application form can be obtained from any LIC agent.

Application Form Download

The application form can be downloaded from the LIC website. The link to the application form is: https://licindia.in/lics-dhan-vriddhi-plan-no-869

Helpline Number

The helpline number is 1800-227-7171.

Conclusion

LIC Dhan Vriddhi Plan is a secure and lucrative investment option that offers a guaranteed maturity amount and regular income. The plan is also flexible and provides protection against premature death. If you are looking for an investment plan that offers these benefits, then it is a good option for you.

FAQs

What is the minimum sum assured for LIC Dhan Vriddhi Plan?

The minimum sum assured is Rs. 10,000.

What is the maximum sum assured?

The maximum sum assured is Rs. 50 lakh.

What is tenure?

The tenure is 10, 15, or 20 years.

What is the guaranteed interest rate?

The guaranteed interest rate is 7.4%.

How can I apply for LIC Dhan Vriddhi Plan?

You can apply online or offline. The online application form can be found on the LIC website. The offline application form can be obtained from any LIC agent.

I hope this article is helpful and informative. Please let me know if you have any other questions.